By A Mirsab, TwoCircles.net,

Aurangabad: Muslim students in Maharashtra are facing problems from various banks in opening of a ‘no frills’ account that is required to avail different scholarships meant for minority students.

As per the procedure, scholarship amount is deposited directly into the bank account of students by the government and hence every student has to provide his bank account while filling up scholarship forms.

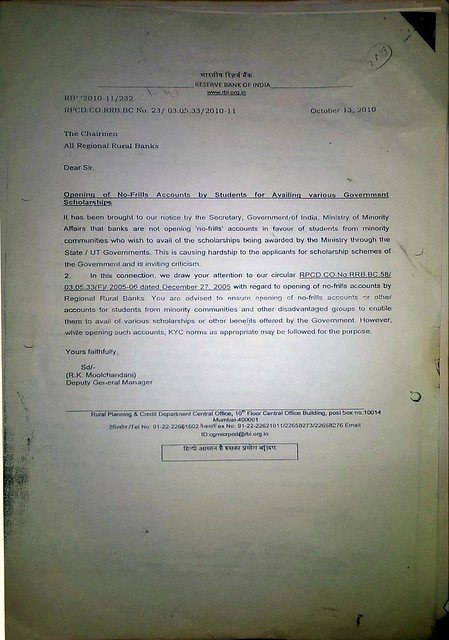

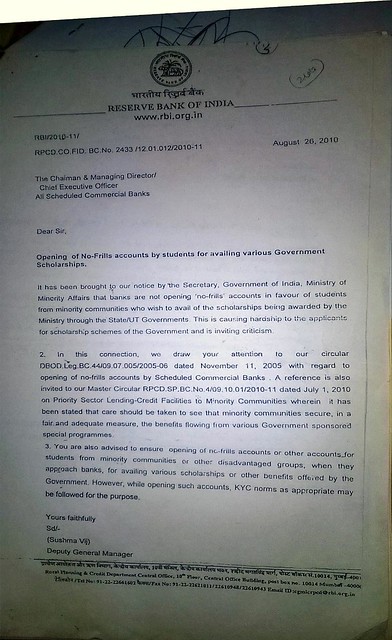

Copy of RBI circular

Muslim students in Maharashtra are eligible to benefit from state and central government sponsored various scholarships such as pre- metric, post-metric, Merit cum means and other scholarship programs meant for minorities in the state.

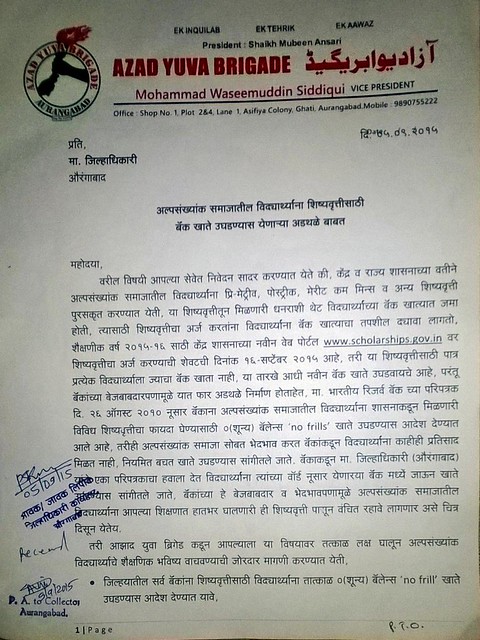

Azad Yuva Brigade, a Marathwada based NGO that monitors and handles issues encountered by Muslim students has written a letter in this regard to state government demanding immediate intervention so that Muslim students may not fail to file their scholarship forms before deadline due to non-opening of a ‘no frills’ bank account.

Waseem Siddique, Vice President of Brigade told TwoCircles.net,” The banks here are not allowing students to open zero balance account and are asking them to open a savings account by depositing Rs. 1000. As per RBI circular in 2010 all banks are advised to open ‘no frills’ account for students availing scholarship but banks are not following this circular and creating hardships for students”.

September 16 is the last date for filling of scholarship forms for academic year 2015-2016 as per government portal www.scholarships.gov.in and those students not having bank accounts needs to open fresh account and provide details while filling of scholarship form.

Siddique alleges that when students are requesting banks to open zero balance account then they are told to fill up forms from banks in their respective wards but if students are filling forms in banks of their vicinity under Jan Dhan Yojna then Banks are telling them that quota of such bank account opening is over.

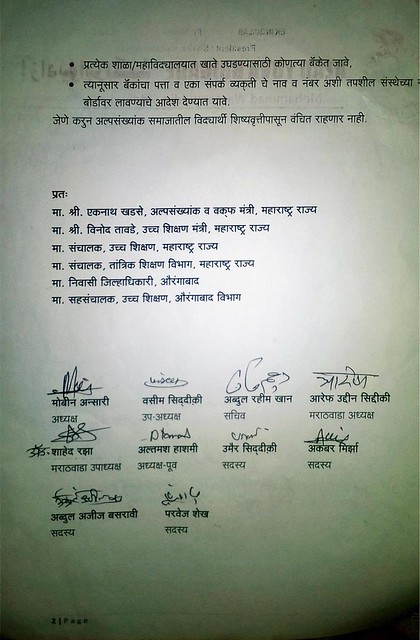

A copy of Azad Yuva Brigade’s letter to state authorities

“Banks are not opening ‘no frills’ account and instead have stationed their agent in schools and colleges who are offering to open a savings account with Rs. 1100 and hence students are being compelled to open such savings account”, Siddique told.

The same issue was brought to the notice of Central government in 2010 due to which Reserve Bank of India (RBI) had issued strict circular to all the commercial banks on August 26, 2010 ordering them to open ‘no frills’ account of minority students when they approach respective banks so that they may not face hurdles in availing scholarships.

Despite such circular in place, Siddique says, “Banks tell students to go to banks in their respective wards because they have been advised by district collector to open account of students living in the particular wards. This is pathetic and demoralizing students.”

When asked if students of other community too are facing same problems, Siddique told, “Other communities do not need to open such accounts. For SCs/STs or OBCs or for Girls to avail scholarship of Savitri Bai Phule there are special government departments that completes the required procedure on behalf of scholarship availing students”.

“But unfortunately there is no such department to help minority students and hence these students regularly face many problems as they are compelled to file their forms on their own”, he adds.