Economy

Economy

27158 articles

Where the Saree Was Born, the Thread Is Breaking: 50% US Tariff Pushes Banarasi Saree Industry to the Brink

Where Floods Return, but Promises Don’t: The Betrayed Legacy of Bihar’s Muslim-Majority Seemanchal

Debate on Constitution in Lok Sabha: PM Modi Pushes for UCC; Rahul Slams BJP on Farmers, Agniveer and UP's Rising Communalism

India’s $111 Billion Remittance Inflow: Triumph or Symptom of Economic Challenges?

इनोवेशन | एक माह में सोलर बाइक बनाने वाले असद की कहानी

More in Economy

Wearing slogans on sleeves: Rupali Jadhav designs her activism on T-shirts

A fashion designer turns her village home into garment manufacturing unit

Empowering Wardha’s Dalits through e-commerce

Giving shoes a new life in Patna

'Nothing will be same ever again,' say residents of Delhi's Shiv Vihar three years after riots

‘Won’t injunct media’, SC refuses plea to gag media from reporting Adani-Hindenburg issue

2020 Delhi riots: 'My soul trembles when I recall that day,' shopkeepers at Gokulpuri tyre market yet to recover from loss, trauma

Property tax in J&K from April; political leaders oppose move

Widespread anxiety in J&K amid intensified anti-encroachment drive

Why are minorities disappointed with Union Budget 2023?

‘No transparency in anti-encroachment drive:’ Kashmir traders' body as govt intensifies 'state land' retrieval campaign

231 days and counting: Sanitation workers at LHMC decry illegal termination

"Was greeted with hearts full of love, not grenades," Rahul Gandhi on concluding Bharat Jodo Yatra in Kashmir

They only come for the poor: Tughlakabad residents who received demolition notices

Van Versus Vikas: New documentary dismantles mythology of India's “progress” from worldview of Adivasi family

Explained: Why is resentment growing in Ladakh three years after UT status?

‘There is rift after 2020 riots,’ say Brahmpuri residents after posters surface urging Hindus not to sell properties to Muslims

Bihar: Hopes and hurdles for minority communities in much-hyped caste census

Demonetisation order ‘unlawful’: What dissenting judge BV Nagarathna said on SC's majority ruling

Uttarakhand: Muslim area residents protest court order for demolition of over 4000 houses, demand rehabilitation

‘Discontinuing Maulana Azad fellowship blow to students from minority community,’ say experts

'Picked up from garbage, dropped in gutter,' Muslim slum dwellers in Ahmedabad see no hope as Gujarat goes to polls

Why are tribals from Jammu and Kashmir protesting inclusion of Paharis in ST list?

What does EWS quota mean for SC, ST, OBCs?

This Muslim-run NGO run in Hyderabad helps women build sustainable livelihoods

सोनभद्र का रामबाबु : वेटर के तौर पर अपमान झेला ,लोकडाउन में नौकरी गई ,मनरेगा में मजदूरी की,अब नेशनल गेम्स में जीता गोल्ड

ग्राऊंड रिपोर्ट : दलितों की बस्तियों का नाम बदलने से नही सुधरेगी उनकी हालात

Khargone riots aftermath: Why a Muslim businessman's shop was demolished?

एक बार फिर जंतर मंतर पर जुटे किसान, लगाया वादाखिलाफी का इल्ज़ाम

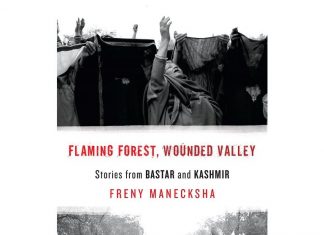

‘Inside the heart of the conflict’, a new book on Bastar & Kashmir challenges state narratives

World Tribal Day: 2-day tribal fair in Jharkhand showcases tribal artworks, culture

Ragpickers seen through the prism of art

Hit by plastic ban, Delhi’s ragpickers search for better livelihood

Adivasi villages in Jharkhand, Odisha face severe neglect, reveals new report

In photos: Kozhikode sewage treatment plant faces stiff opposition from locals

President-elect Droupadi Murmu revives new hope in her nondescript village

‘We are living like prisoners’: Muslims from riot-hit Khargone decry construction of wall separating two communities

'No designation and delayed salaries': Hard lives of Delhi’s Dengue Breeding Checkers

Remarks on Prophet Muhammad: Sale of Indian products hit in Gulf

‘Was forced to change name of restaurant & menu, fire Muslim staff, and hire Hindus,’ claims Muslim restaurateur in UP

Credit society run by Muslims offers respite for low-income wage groups

Uttar Pradhesh's Tharu tribals fear growing privatization will result in lack of govt jobs

For many rural women in Bihar, Kheta embroidery work aims to boost livelihood