By TwoCircles.net News

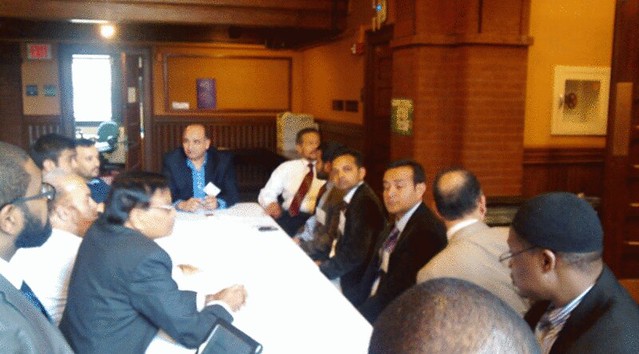

Cambridge, Massachusetts: A roundtable on “Islamic Finance in India” was organized on April 27, 2014 at Harvard Law School at the conclusion of Eleventh Harvard University Forum on Islamic Finance. The roundtable focused on the challenges and opportunities in introducing Islamic finance in India. Many prominent Islamic finance experts from Middle East, Europe, America, Africa and the subcontinent participated in the roundtable and shared their insights and experiences.

Dr. Nazim Ali, Director, IFP at Harvard introduced the theme to the panelists. The roundtable was chaired by Professor Elsayed Elsiefy of the Qatar Faculty of Islamic Studies. Dr. Shariq Nisar, Visiting Fellow at Harvard Law School presented an overview of the Indian financial system highlighting obstacles and the opportunities for Islamic finance. He touched upon banking, financial companies, insurance and capital market areas.

Mr. Ishtiaq Ali, Partner ClasisLaw Firm in Mumbai and a project finance expert briefed the panel about the prevailing rules and regulation in project financing. He also deliberated on the rules for FDI and FII. Dr. Asif Akhtar Assistant Professor from Aligarh Muslim University shared his research findings on the possibility of Islamic banking and finance in India. He emphasized on the role of Islamic finance in improving financial inclusion and sustainability.

Hussam Sultan from UK and a key officer on sustainability at HSBC Amanah shared his experience of introducing Islamic banking in the UK. He emphasized the importance of customer awareness and political lobbying. Dr. Umar Oseni, an expert on Islamic Dispute Resolution from International Islamic University Malaysia expressed his views on the legal and regulatory framework of Islamic Finance in the light of Malaysian experience.

Dr. Mohammad Faisal, Assistant Professor from Aligarh Muslim University, briefed the panel about the growing awareness of Islamic finance among Indian consumers. He proposed a strategic overview on the political risk and branding of Islamic financial products in India. Mr. Sajjad Shah of Wellington Management, USA shared his experience of fund management and the strategies that could be adopted to promote ethical investments.

The panelists included prominent industrialist Ali Alobaidli Group CEO Ezdan Holding, Qatar and Maulana Hassan Khan of Barkatullah University Bhopal. The Chair Professor Elsiefy enquired about the Islamic capital market opportunities and the FDI requirements for direct investments in the Indian economy. At the end he thanked all the participants for their valuable comments.

Many prominent industrialist, educationist, financial experts, philanthropist and students from India participated in the three-day-long Forum. Bearys Group Chairman Syed Mohammad Beary; BSAR University Chairman, Abdul Qadir Abdul Rahman Buhari; Chairman, Zakat Foundation of India Syed Zafar Mahmood; Baitun-Nasr founder Mr. Mohammad Husain Khatkhatay; BSE Brokers’ Forum Chief Executive Mr. Vispi Bhathena and Chief Economist Dr Aditya Srinivas; Mr. Saif Ahmed of Zamzam Capital; Niyash Mistry of Fletcher School; and Mr. Kashif-ul-Huda of TwoCirlcles.net also participated in the Forum.