By Afroz Alam Sahil, TwoCircles.net

New Delhi : The Narendra Modi-led NDA government had last year announced a cess of 0.5 % to be collected for the purpose of Swacch Bharat Abhiyan in an attempt to boost the clean India initiative. This cess became effective from November 15, 2015 on all services liable for service tax.

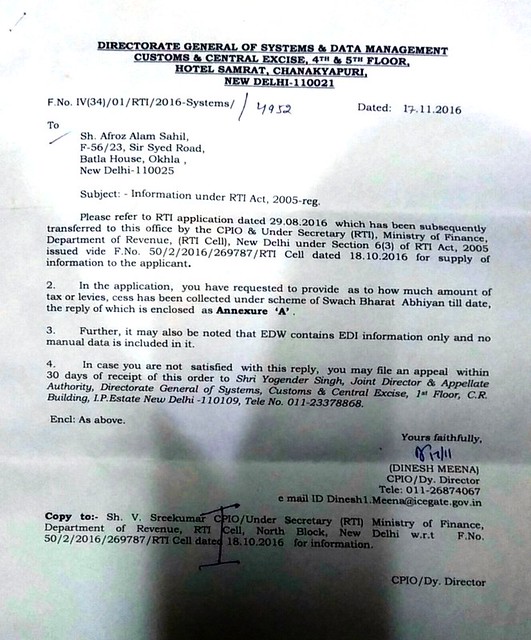

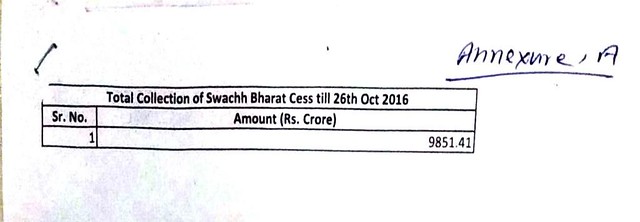

According to an RTI filed by TwoCircles.net, a sum of Rs 9,851.41 Crore has been collected till the Oct 26, 2016.

TwoCircles.net filed an RTI to the Dept. of Economic Affairs (Ministry of Finance) to provide as to how much cess has been collected under scheme of Swacch Bharat Abhiyan till date. The Dept. of Economic Affairs forwarded this RTI to Department of Revenue, and Department of Revenue forwarded this RTI to Directorate General of Systems & Data Management, Central Board of Excise & Customs (Ministry of Finance).

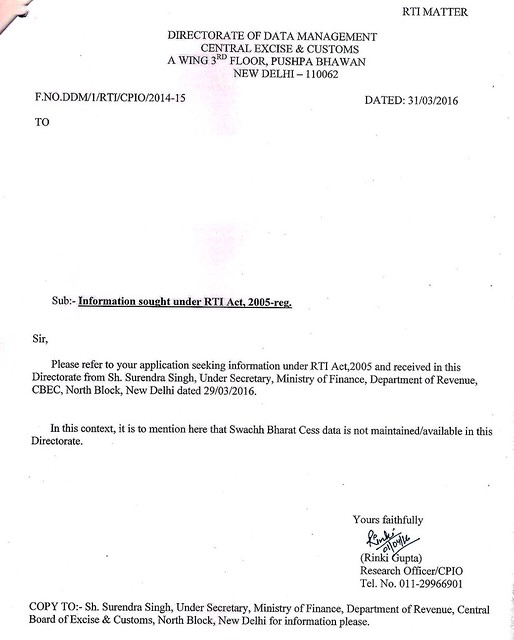

The Directorate General of Systems and Data Management, which sent the written reply to TwoCircles.net, had interestingly said in a previous RTI query that the Swacch Bharat Cess data is not maintained/available with them.

This RTI was filed on 19th March 2016 from Ahmadabad to know about the exact amount collected from the Swachh Bharat Cess in the period 16th December to till that date, and also to know about the utilization of this fund for Swachh Bharat Initiatives. On 21st March 2016, RTI was transferred to Public Authority Department of Revenue. On the next day, it was again transferred to Public Authority Central Board of Excise and Customs. After doing the rounds of 3 departments, this RTI got a negative reply which stated that, ‘Swacch Bharat Cess data is not maintained/available in this Directorate’.

In budget 2015-16, the government had put the service tax collection target at over Rs 2.09 lakh crore. It is expected that the Swachh Bharat cess would yield Rs 400 crore over and above the service tax collections.

The last budget also increased service tax from 14.5% to 15% on select services by levying 0.5% Krishi Kalyan (farmers’ benefit) Cess, which the government has promised to spend on agriculture.