India to become second country outside the Islamic world to run sharia compliant MF, will Islamic banking follow?

By M Reyaz, TwoCircles.net,

New Delhi: Country’s largest public sector bank the State Bank of India is launching an ‘open ended equity scheme’, complying with the Islamic laws, popularly known as ‘Sharia equity fund’ in December.

The new fund will open on December 1, and closes on December 15, 2014.

The Securities and Exchange Board of India (SEBI), the financial regulator, recently allowed the government-owned SBI and three mutual funds to launch Sharia funds.

India will become the second country outside the Islamic world where government run bank will run sharia compliant MF. The United Kingdom had in June issued sovereign Islamic bonds.

Earlier this year, the then Minority Affairs Minister K Rehman Khan had pushed for Sharia mutual funds as the government otherwise appears hesitant to allow ‘interest free’ banking system that requires amendment to the laws governing the Reserve Bank of India.

Several groups have been lobbying for years now for interest-free Sharia compliance banking system to be allowed in the country to tap into investment opportunities from the country’s 170 million Muslims, who are otherwise hesitant to invest their money as riba or interest is considered Haram (forbidden) in Islam. Islamic banks are hence not permitted to charge usurious interest and investments are treated on the basis of the performance of underlying assets, unlike prevalent system of interest-bearing loans.

Globally Islamic banking assets, tapped by major bankers from Standard Chartered to HSBC touch about $1.8 trillion (Rs 112 lakh crore), according to Ernst and Young.

The Sharia compliant mutual fund will be launched by SBI Mutual Fund Trustee Company Pvt. Ltd. The SBI memorandum of Sharia mutual funds makes it very clear that the investment objective of the scheme is to “provide medium to long term capital gains by investing in Shariah Compliant Equity & Equity related instruments. The fund will invest in money market instruments only if they are approved by the Shariah Board.”

The scheme will be governed by a Shariah advisory board, which will be appointed by the investment manager and the board will work towards Shariah structuring, Procurement of Fatwa, Shariah review of legal documents, Shariah screening of stocks, and Shariah audit.

“The corpus of the scheme will be invested in the companies which are approved by the Shariah Board. The Fund Manager’s endeavour will be to identify the stocks which can generate long term capital appreciation for investors from the of shariah compliant universe. The portfolio will have a blend of growth and value stocks. The portfolio will invest into stocks across market capitalisation,” the memorandum further explains.

Noting that the “Shariah compliant stocks are the stocks which adhere to Shariah principles,” it further explained that the business activities related to pork, alcoholism, gambling, pornography, tobacco, trading of gold and silver as cash on deferred basis. While newspapers have been allowed, other sub-industries related to media will be “analyzed individually,” and decision would be taken based on direction of the Sharia Board.

There are over 600 companies in India’s stock exchanges that can fall under its ambit. Analysts believe that even though such open ended funds have restrictions; their performance is still strong as they invest in country’s leading growing sectors such as auto firms, pharmaceutical, software, etc.

Earlier, owing to insistence by the Minority Affairs Minister, the SBI had sent a team to Malaysia, which runs a similar successful model. The fund may be utilised to finance Haj and other welfare schemes meant for minorities that may enable the government to gradually stop subsidising the pilgrimage.

(Courtesy: Wall Street Journal)

According to MoneyControl.com, in the mutual fund space, there are currently three major Shariah compliant funds, one of which is a passively managed fund, while the other two funds are actively managed: Benchmark Mutual Fund (recently acquired by Goldman Sachs group) was the first to launch a Shariah based ETF called the Shariah BeES (now renamed as GS S&P Shariah BeES) in March 2009. This was followed by Taurus Mutual Fund, which launched an actively managed Shariah Compliant fund ‘Taurus Ethical fund’ in the same year. After this, there was a repositioning of a 15-year-old equity diversified fund from the Tata stable called Tata Select Equity Fund, which has been renamed as Tata Ethical Fund, in September 2011.

Current scenario:

In India, although full-fledged Islamic banking has not begun yet, it has some presence in the form of NBFCs and Baitul Mal (Islamic Treasury) catering to the niche segment. Kerala government-owned KSIDC has started Al-Barakah Financial Services Ltd recently. GIC of India runs an Islamic re-assurance scheme.

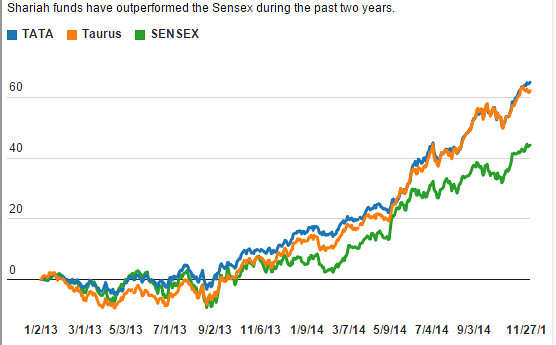

Besides, TASIS, an index on the Bombay Stock Exchange representing only Sharia-compliant stocks, is the first of its kind in India. Last year, in May, the Bombay Stock Exchange had launched India’s first Shariah index — S&P BSE 500 Shariah, that in one year has offered 49% returns, compared to the 41% rise of the benchmark Sensex, according to the Wall Street Journal.

There are several smaller companies which have begun in recent years that have worked to provide integrated platform of distributing and broking of shariah based investment products and services. Speaking at an economic summit aimed at exploring opportunities for minorities, Khalid Ali, MD of Multigain Company spoke on opportunities for investments in compliance with the Sharia principles.

Not for Muslims alone:

Interest free banking system is simply an alternative financial system that works on the principles espoused by Islamic values and hence generally referred to as Islamic or Sharia compliant. However, there is nothing that restricts non-Muslims from investing in such a system. Islamic banking gained credence after the 2008 economic downturn, when it practically faced no financial crisis.

Contrary to the belief, more than Muslims, whose investment capacity is limited, biggest gainer can be another business community – Jains, who though numerically small, are influential investors. Even Jains refrain from investing in companies involved in alcohol, tobacco or gambling; and they too have been demanding specific Jain stock index based on their religious beliefs.

Sharia compliant funds meanwhile find easy buyers among them. The WSJ quotes Ramesh Kabra, vice president marketing with Taurus Mutual Fund, saying that close to 50% of investors in Shariah funds are from the Jain community. Gujarati Muslim communities, particularly the Bohras, who are trading community, too have shown enthusiasm.

In Malaysia, although both the systems of banking operate, more than 40% of the customers of Islamic banks are non-Muslims.

Legal hurdles in Sharia banking:

Although the government has allowed the mutual funds, it has made it clear that the current law does not permit interest free banking system in the country. Besides the name, which can raise eyebrows in a communally sensitive society, the main hurdle against sharia compliant Islamic banking system is legal.

The government has maintained that it is not legally feasible under existing laws. Urging that the existing laws be amended, H Abdur Raqeeb, general secretary, India Centre for Islamic Finance (ICIF) that has been advocating permission for Islamic banking, however, argues in favour.

“Islamic finance has emerged as a viable alternative world over after the financial meltdown of the west. It is growing at the rate of more than 15%. Not only Muslim countries but modern, secular and industrialized countries such as UK, France, Japan, Singapore and Hong Kong too have become hub of Islamic finance & banking. Even World Bank considers it as a priority area,” Raqeeb said.

Calling it as a positive step, he welcomed the SBI’s initiative to launch such a mutual fund.

The current RBI Governor Raghuram Rajan is favourable to an alternative system. As Chief Economic Advisor to the Ministry of Finance, had a headed a high-profile committee on financial sector reforms, which had in its report, advocated for amendments to the existing laws to allow interest free banking operate, but it had received cold response from the government.

Even Sachar Committee had outlined that the Muslim community becomes a victim of financial exclusion.

A 2012 ‘Thought Paper’ by Infosys on “Why India needs Islamic Banking?” had concluded, “By not introducing Islamic finance, India is losing the opportunity of garnering capital from a large section of the Muslim population as well as from Islamic nations in the Middle East and elsewhere.”

Investment from Gulf countries:

Experts are of the opinion that allowing Sharia compliant system in the country can allow investment to the tune of several billion dollars from the Gulf countries, who are otherwise hesitant to invest in interest-based financial system.

Dr Javed Ahmad Khan, the Officiating Director of Center for West Asian Studies in Jamia Millia Islamia, who teaches Contemporary Arab Economics, told TwoCircles.net, “Both private investors and sovereign welfare funds of the governments can fetch huge investment for the country, particularly in the infrastructure sector. They are quite inclined to invest in India, but that will require some amendments in the existing laws of SEBI and RBI.”

Dr Khan, who is also the author of India and West Asia: emerging markets in the liberalisation era (1999) and Islamic Economics and Finance : A Bibliography (1995) reminded that countries such as the United Kingdom, China, Russia, and South Africa have already amended their respective laws and allowed for an alternate system to tap into this huge investment opportunity.

Will be beneficial to small artisans and craftsmen:

The current NDA government has spoken of uplifting the small artisans and craftsmen. Arguing that basic principles of micro-financing and Islamic banking are “very similar,” Dr Khan said permitting Islamic banking can help a long way in economic inclusion of large segment of minority communities, who are engaged in unorganised sector and in small scaled industries or are artisans and craftsmen.

Related:

Is Islamic banking the boiled ice-cream?

Benefits of ‘modern’ Islamic banking

An interview with Dr Shariq Nisar, the architect of India’s Shariah Index

Islamic banking in India: Challenges and prospects